What are Elliott waves?

In the 1920s, Ralph Nelson Elliott discovered recurring patterns in financial market prices. He called these patterns Elliott waves. These patterns repeat at both large and small timescales, and are nested within one another hierarchically. Long before the concept of a fractal existed in mathematics, Elliott discovered that financial markets are fractals.

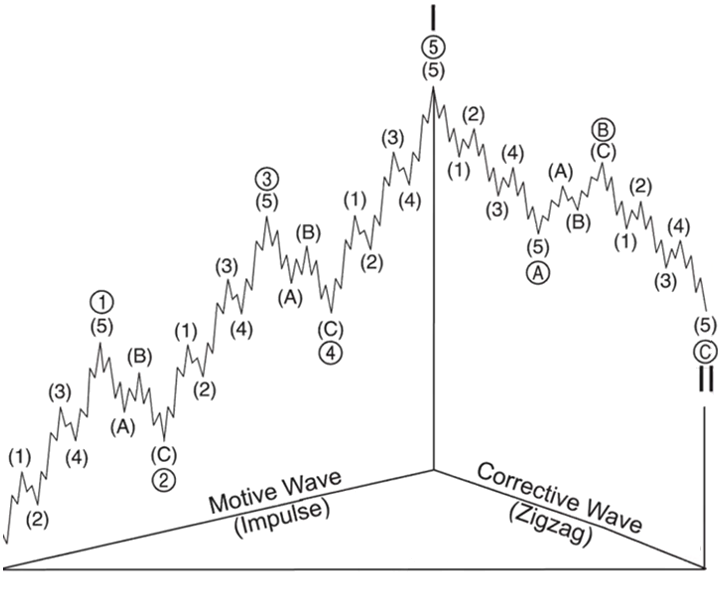

Under Elliott wave theory, a complete market cycle consists of a wave of progress, called a motive wave, followed by a wave of partial retracement, called a corrective wave.

Most motive waves subdivide into a 5 wave impulse pattern (1-2-3-4-5), while most corrective waves subdivide into a 3 wave zigzag pattern (A-B-C). We end up with a fractal because each pattern’s component waves subdivide into patterns themselves.

Elliott waves follow strict criteria. They are governed by (1) a recursive grammar specifying which patterns are allowed where, (2) a set of rules that each pattern must follow in terms of price and time behavior, and finally, (3) a set of guidelines, which deal in probabilistic behavior. The combination of the grammar, the rules and the guidelines form the Elliott Wave Principle.

If you are new to Elliott waves, this can all seem like a lot to take in. The following videos will help elucidate the concepts much further.

What is the Elliott Wave Principle?

Trading with the Wave Principle

Still confused? Read a free copy of the classic text, the Elliott Wave Principle.