How powerful is EWAVES? Let the numbers speak for themselves. Imagine acting on just two EWAVES calls this year:

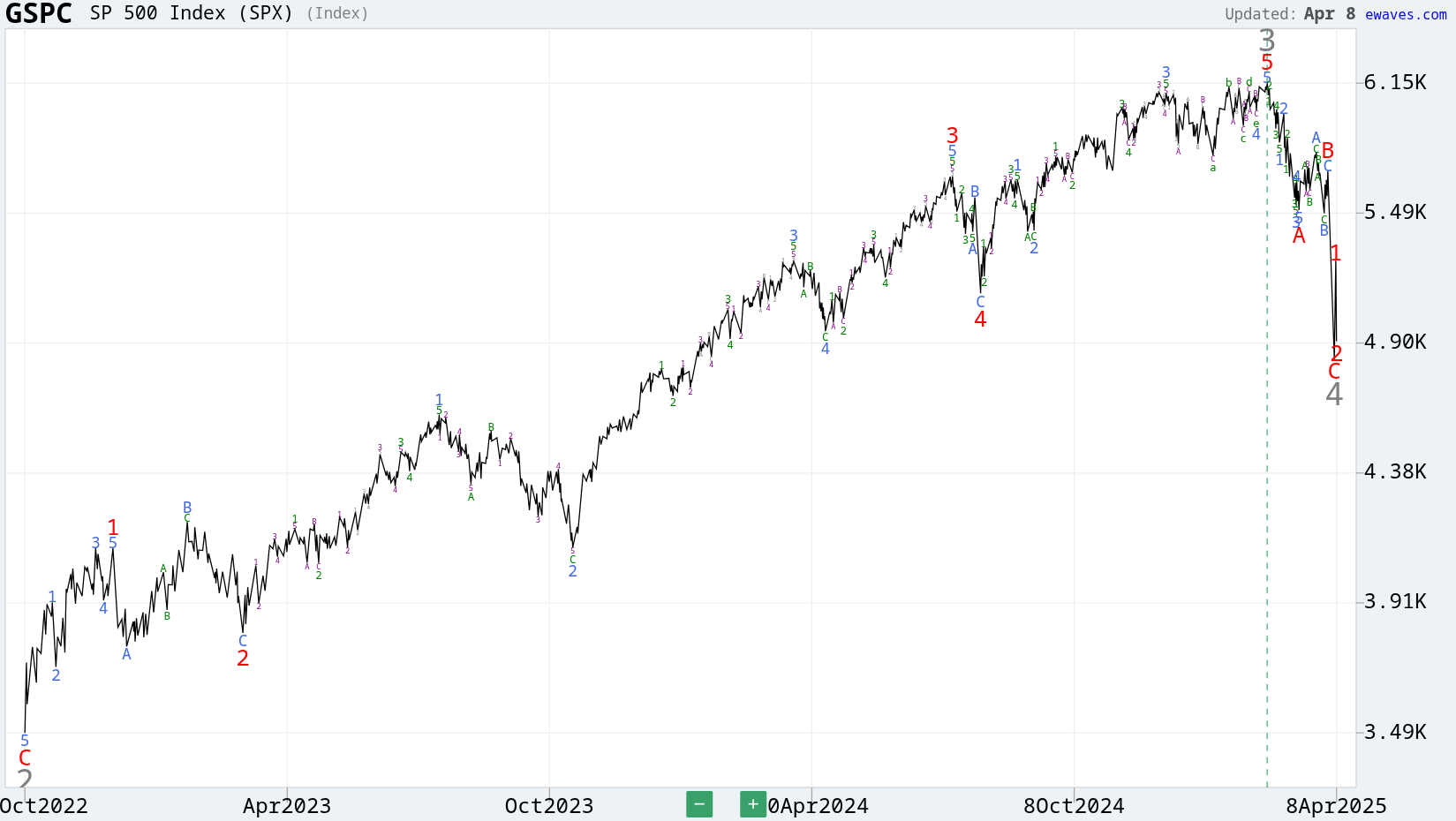

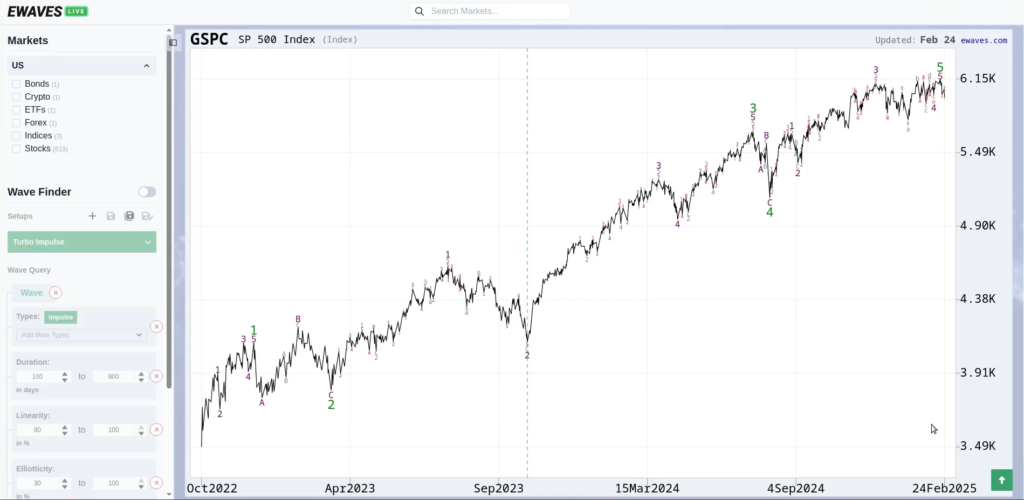

February 24, 2025: EWAVES identified the termination of a 2-year long uptrend before the S&P 500 closed that day at 5983. A short there, covered at the 4982 close on April 8th when EWAVES recognized that the decline was over, would have delivered 1,001 S&P points.

April 8, 2025: EWAVES turned bullish, with waves labeled to indicate a move to new all-time highs. Buying at the close around 4982 and staying with EWAVES’ bullish opinion into the July 22nd close at 6309 (a conservative bullish target) delivered another 1,328 S&P points.

That’s a total of 2,329 S&P points, following just two calls from EWAVES. With just a single S&P E-Mini contract, those points would be worth $116,450.

This isn’t hindsight. These were real-time forecasts, made before the turns, with precise wave labeling and elliotticity confidence scores.

Prepare for what’s next in the markets by getting started with EWAVES Live today.