News

-

Why Is Gold Breaking Records?

Will the future be inflation or deflation? EWAVES shows that we don’t have to endlessly armchair-theorize about debt and monetary policy. We can simply follow gold’s Elliott wave price patterns.

Want to test out the EWAVES engine for yourself? Get started with EWAVES Live today.

-

Forecasting the COVID Market Crash & Recovery

The COVID crash wasn’t chaos: it was structure. See how EWAVES mapped the exact shape of the 2020 market collapse and full recovery before it happened, without lagging indicators or moving-average whipsaws.

Want to test out the EWAVES engine for yourself? Get started with EWAVES Live today.

-

EWAVES Engine Upgrade: Now Live with Version 3.5

We’ve just rolled out the most significant EWAVES engine upgrade in years.

Upgraded => Version 3.5

What’s New in Version 3.5?

Divergence Recognition – EWAVES now detects price divergences, helping you anticipate wave termination points with greater confidence.

Smarter Price Channels – Impulse channels (1–3/2–4) can now be anticipated before wave 3 forms, improving targeting. And for the first time ever, flat corrections feature a clearly defined and effective price channel.

Carefully Tuned Biases – EWAVES has improved how it applies the exact historical probabilities of every pattern (zigzag, flat, triangle, etc.) across all positions (2, 4, B, X, etc.), enabling it to anticipate the most likely next-pattern before it fully unfolds.

Re-Tuned Guidelines – The relative importance of each Elliott Wave guideline has been recalibrated against the historical database using improved modeling techniques, aligning analysis more closely with real market behavior.

Stabilized Wave Extrapolation – The extrapolation system has been upgraded, improving EWAVES’ ability to foresee the full duration and magnitude of partially formed waves. The extrapolations are much more stable than before, reducing how often EWAVES changes its mind as it counts.

Accuracy Boost – Validated against our database of iconic Elliott Wave counts, EWAVES 3.5 has achieved all-time highs in historical accuracy.

You may notice refined wave patterns after the upgrade as the system applies its enhanced capabilities.

Want to test out the EWAVES engine for yourself? Get started with EWAVES Live today.

-

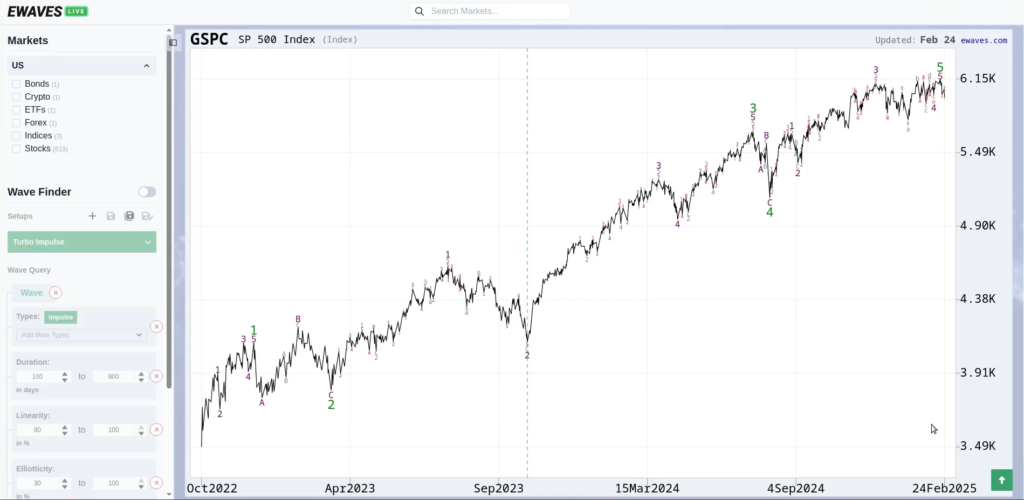

EWAVES Has Logged 2,329 S&P Points Since February

How powerful is EWAVES? Let the numbers speak for themselves. Imagine acting on just two EWAVES calls this year:

February 24, 2025: EWAVES identified the termination of a 2-year long uptrend before the S&P 500 closed that day at 5983. A short there, covered at the 4982 close on April 8th when EWAVES recognized that the decline was over, would have delivered 1,001 S&P points.

April 8, 2025: EWAVES turned bullish, with waves labeled to indicate a move to new all-time highs. Buying at the close around 4982 and staying with EWAVES’ bullish opinion into the July 22nd close at 6309 (a conservative bullish target) delivered another 1,328 S&P points.

That’s a total of 2,329 S&P points, following just two calls from EWAVES. With just a single S&P E-Mini contract, those points would be worth $116,450.

This isn’t hindsight. These were real-time forecasts, made before the turns, with precise wave labeling and elliotticity confidence scores.

February 24, 2025 – Bearish Setup

April 8, 2025 – Bullish Setup

July 22, 2025 – Conservative Bullish Target Met Prepare for what’s next in the markets by getting started with EWAVES Live today.

-

Elliott Speaks at the Foundation for the Study of Cycles

Elliott Prechter recently spoke for the Foundation for the Study of Cycles. In his presentation, Elliott reveals the inner workings of the EWAVES engine, and how it scans markets to spot high-confidence Elliott wave patterns. He also shares recent, real-world EWAVES analysis on key markets such as the S&P 500 and treasury bonds.

Want to test out the EWAVES engine for yourself? Get started with EWAVES Live today.