EWAVES Live includes the Wave Finder, which is the world’s first Elliott wave search engine. It is a query system for quickly finding currently-unfolding Elliott waves based on precise criteria.

There are built-in setups that you can use directly to find Elliott wave setups, or you can modify them, and save your modifications as your own custom setup.

Built-In Setups

Breakout from Correction

This setup closely follows the setup described in Visual Guide to Elliott Wave Trading. It targets unfolding impulse waves that have recently begun via the following query criteria:

- Duration (Expected): This estimates the total expected length of the impulse wave, rather than how long it has been unfolding so far. The default range is 100–400 days but can be adjusted.

- Wave Labels: Set to 3, 5, or C. These positions are commonly where impulse waves occur, but more importantly, they follow earlier waves that provide context (e.g., a 3 follows a 1-2; a C follows an A-B). These setups are described in the book and provide critical structure cues.

- Breaks Baseline of Prior: This condition requires that price has already broken out of the trend channel of the prior wave. It ensures that the move has already started and isn’t purely theoretical. This condition is included by default, but was removed in the below example, in order to focus on much being catching the new gray wave 5 up even earlier in its development that this restriction would require.

- Breaks Baseline of the Last of Prior: This condition requires that price has already broken out of the trend channel of the prior wave’s last wave, which in the example below, is the baseline of red wave C of gray wave 4. This is similar to breaks baseline of prior but can catch a new wave much earlier in development, though at the cost of less confirmation of the newly ensuing wave.

- Limits Set to Prior: This ensures that the impulse hasn’t already exceeded the full price territory of the previous wave (e.g., wave 4). If it has, the setup is considered too late to act on.

- Prior Wave Type: Required to be a corrective pattern—zigzag, flat, triangle, or double zigzag. If you’re only interested in breakouts from certain types (e.g., triangles), simply deselect the others.

- Parent Wave Included: Including the parent wave doesn’t alter the query results but does affect chart zoom. It ensures that the wave one degree higher is fully visible in the result, offering more visual context. For example, this allows you to see the full 1-2-3-4 sequence leading up to the target wave.

Note that in addition to Breakout from Correction, there are various sub-flavors of this setup for specific types of corrective waves: Breakout from Double-Zig, Breakout from Flat, Breakout from Triangle and Breakout from Zigzag.

Breakout from Diagonal

The Breakout from Diagonal setup is similar to the Breakout from Correction, but with one key difference: a diagonal is a motive wave, not a corrective wave, since it moves in the direction of the main trend. However, ending diagonals (the most common type) signal weakness in the main trend and often precede a major reversal. In fact, when it comes to identifying major trend reversals, ending diagonals are arguably the most powerful signals.

When diagonals complete, they are usually retraced swiftly. For example, in the chart of BYD Company Limited shown below, we would expect the market to quickly fall toward the red wave B around $67.

This setup is conceptually simple: we want the market to break the 2–4 line of the diagonal, confirming that the diagonal has completed, but we don’t want the entire diagonal to be retraced yet, or else the opportunity would already be gone.

Channeling Impulse

The Channeling Impulse setup, as the name suggests, focuses on an impulse wave’s channel adherence. Simply put, this means that the 2–4 line and the 1–3 line are closely parallel. Not only does this increase the likelihood of a correctly identified impulse wave, it also establishes clear boundaries for future price action (for example, wave 5 should continue to respect the channel).

To ensure that wave 4 is complete (and therefore that we can reliably measure channel adherence), we require that wave 5 break below point A of wave 4. This eliminates the possibility of wave 4 developing into its own five-wave move. This check is performed via the Child context wave (which represents wave 5, the last child of Wave). Specifically, we require it to break the 1st of prior (in this case, A of wave 4).

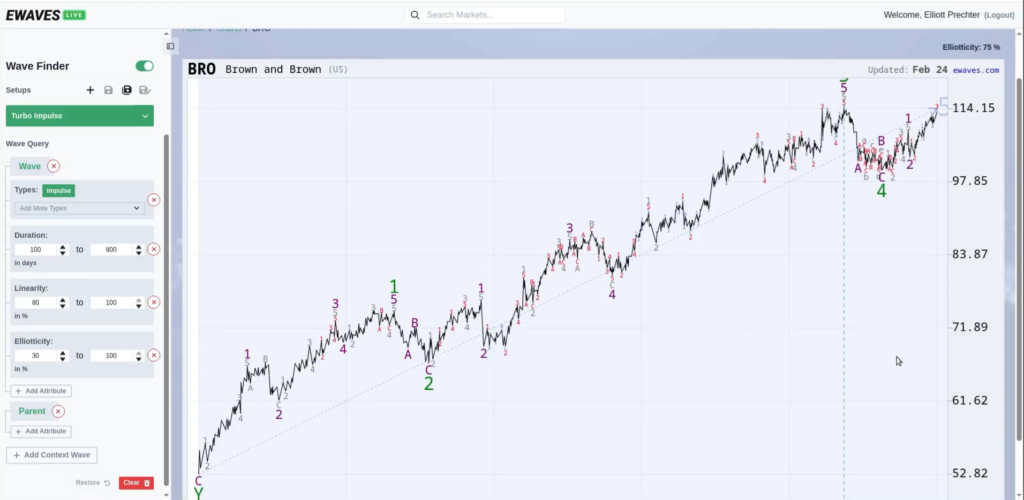

Turbo Impulse

The Turbo Impulse setup looks for an unfolding wave of type impulse, which, in Elliott Wave theory, is the pattern that exhibits the most price progress.

- Duration: This is set between 100 and 800 days by default. It specifies how long the wave has been unfolding. You can adjust this range based on your timeframe: shorter for swing trading, longer for long-term investment perspectives.

- Linearity: Required to be 80% or higher. Linearity measures how “line-like” the wave is. High-linearity waves show minimal internal overlap, creating a cleaner, sharper price movement. Impulse waves already tend to be linear, but those with even higher linearity are especially strong (hence the name Turbo Impulse).

- Elliotticity: Set to a minimum of 30%. This ensures a baseline level of Elliott Wave clarity, helping provide confidence in identifying the wave’s current position in its pattern. In the example below, after sorting the results by Elliotticity, the top-ranked wave occurred in U.S. stock BRO, with an Elliotticity of 75%.

Turbo Fifth

The Turbo Fifth setup focuses on finding markets with wave structure meeting the following strict criteria:

- Unfolding fifth waves within large impulse patterns. Focusing on fifth waves gives EWAVES the full context of prior waves 1–2–3–4, allowing it to measure channeling, proportion, and dozens of other factors that can’t be judged earlier in a trend.

- High elliotticity long-term structure. A clear pattern in waves 1–4 greatly increases the odds that wave 5 will push beyond the end of wave 3.

- High linearity short-term structure. We want high linearity within wave 5 itself, defined by small 2nd and 4th subwave pullbacks relative to large advancing subwaves 1, 3 and 5. While usually a trait of wave 3 of 3, some fifth waves exhibit it, and those are the ones we want.

- Alternative counts eliminated early. Wave 5 must have overlapped wave A of 4 and broken out of the channel from the final subwave of 4. These two requirements eliminate many alternative counts while still catching wave 5 relatively early in its formation.

Turbo Fifth Prebreakout

The Turbo Fifth Prebreakout follows the same criteria as Turbo Fifth, but the entry is done before the breakout to new price extremes. In additional to the Turbo Fifth criteria, it has:

- Prebreakout positioning. The fifth wave must still be within the price territory of wave 4, meaning we enter before the momentum-chasers pile in. The goal is to anticipate the move, then exit into the excitement of the latecomers.

- Conservative exit. The most conservative target is to exit once price moves outside the prior wave 4’s territory. Many fifth waves go much further, but this approach aims for reliability over home runs. This is especially true because this setup focuses on long-term pattern clarity, not the clarity of wave 5 itself.